Amortization timetable: A table showing how Each and every month-to-month payment is dispersed amongst principal and desire.

Car loans guideBest vehicle loans permanently and undesirable creditBest auto loans refinance loansBest lease buyout loans

Up coming, evaluation the lender term sheets close to one another to select which loan will set you back fewer as time passes. In addition to the APR, concentrate to closing costs, origination service fees, prepaid pursuits, and also other expenditures that can impact your every month payment and the overall Price within your mortgage loan.

To determine your DTI ratio, divide your ongoing regular personal debt payments by your month-to-month cash flow. To be a normal rule, to qualify to get a house loan, your DTI ratio mustn't exceed 36% of one's gross month to month income.

Ashford recruiters advised college students they'd be able to do the job as instructors, social personnel, nurses, or drug and alcohol counselors. But Ashford in no way obtained the necessary state approval and/or accreditation for college kids to enter these professions, this means learners wasted several years in their lives and incurred tens of A huge number of pounds of personal debt for levels they might not use.

Does the lender have a fantastic name? Do you find a significant quantity of complaints on the web? How about customer care, are they responsive?

Mike attained a grasp’s diploma in community affairs reporting with the College of Illinois and continues to be a journalist for over 20 years. He also has available his experience in quite a few Tv set, radio and print interviews.

Totally! You could constantly adjust your payment date with your dashboard. Remember that for those who extend your billing period of time by on a daily basis or more, chances are you'll pay added curiosity about the lifestyle of one's loan.

When you take your loan supply, you could assume to acquire your money within just 1 business enterprise working day of clearing verifications. You'll want to Examine your electronic mail or Update dashboard for any document requests, because we may perhaps ask for specific paperwork to validate your identity ahead of finalizing the loan.

Credit score:Also called a FICO score, a credit history rating is usually a numerical rating summing up how well you’ve paid back previous debts. It’s dependant on no matter whether you’ve paid out your credit card charges on time, the amount of of one's complete credit rating Restrict you’re working with, the duration of your respective credit rating heritage, and other aspects.

If the person provides a spotless monetary report, it could truly assist you obtain a loan with fantastic terms. That said, you'll want to Remember that when you default, it will also influence the economical document of the cosigner. Be certain it’s someone who gained’t maintain this about you, and who you could function with to pay off the financial debt.

Simplicity and Pace: A serious gain that on the net lenders have around banking companies is that they typically eliminate many the bureaucracy from the procedure. This implies an easier and quicker process with the borrower. Some lenders can transfer cash for you in as a little as a couple of days.

Every lender has its very own demands for loan approval. Even so, most home finance loan lenders demand a credit card debt-to-cash flow ratio of no more than 43% along with a credit rating of no less than 580 depending upon the 2300 loan kind of mortgage loan.

Ideal credit history cardsBest reward give credit history cardsBest equilibrium transfer credit history cardsBest vacation credit history cardsBest hard cash again credit history cardsBest 0% APR credit history cardsBest benefits credit rating cardsBest airline credit score cardsBest higher education scholar credit score cardsBest credit cards for groceries

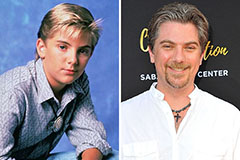

Ross Bagley Then & Now!

Ross Bagley Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Nancy McKeon Then & Now!

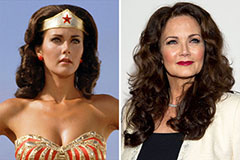

Nancy McKeon Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!